Getting your finances in order takes a load of stress off you when you feel in control of your money. To get yourself organized, you'll need a way to track your budget.

Here's a list of the best free printable budget worksheets to get your money act together.

Disclosure: Opinions expressed are our own. If you buy something through any of our affiliate links on this page, we may earn a commission at no extra cost to you. Thanks for supporting our site.

Jump to:

- Recommended resources

- Family budget worksheet

- Debt snowball worksheet printable

- Monthly template and expenses tracker

- Household binder printable pack

- Monthly budget calendar

- Paycheck budgeting printable worksheet

- Bill pay checklist

- Financial binder printables pack

- Financial budget printables set

- Family budget binder

- Chic feminine budget binder

- Budget template with categories

- Simple budget worksheet

- Conclusion

Recommended resources

- Learn the best way to budget from the king of money* or the queen of budgeting*

- Colorful cash envelopes* to literally budget your money

- A budget planner* that's totes adorbs

Family budget worksheet

This simple household budget printable template helps you budget your income for categories like housing, monthly expenses, and long-term expenses.

One great tip offered from this blog post is to budget for one-time expenses that you know are coming up months in advance.

That way, you are saving a little spread out over many months rather than scrambling to save a significant chunk at one time. (via A Mom's Take)

Debt snowball worksheet printable

This one is based off the debt snowball method from money expert Dave Ramsey*.

He says that people are more likely to stay motivated to work on their money goals if they start by focusing on fully paying off the smallest debt amounts first and then work their way towards paying off larger loan balances.

This free printable Dave Ramsey worksheet helps you track these debt amounts and your progress.

Monthly template and expenses tracker

This free two-part monthly budget printable includes a budget sheet with more detailed categories than the first printable and an expenses tracker to fill in what you spend money on in a particular month. (via Printable Crush)Household binder printable pack

This kit includes multiple trackers and budget worksheets:

- annual and monthly budget worksheets

- bank account and bill payment log

- debt worksheet

- even a tracker for tax deductions

- printable labels

(via World Label)

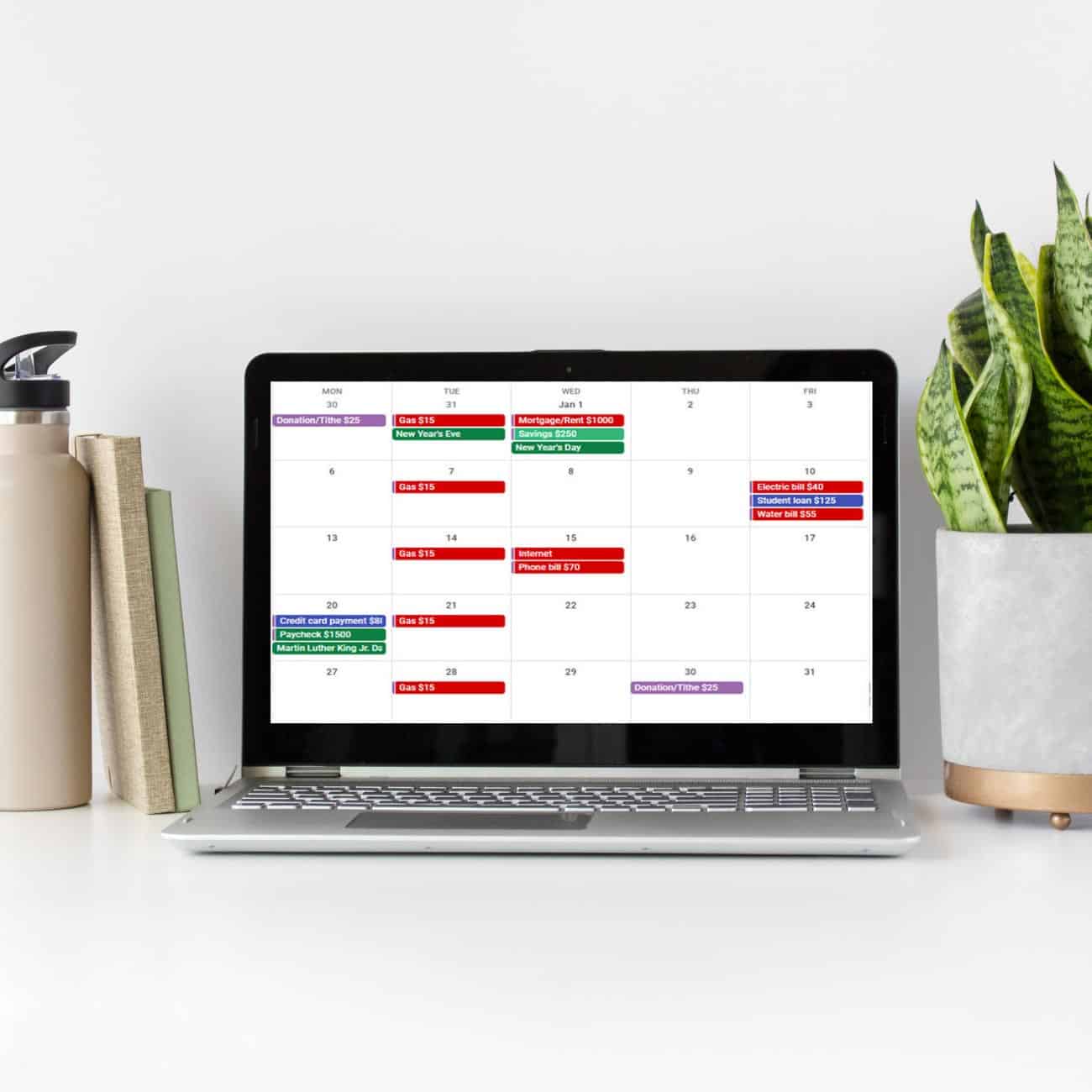

Monthly budget calendar

Find variations of monthly printables on this post, including a free Google calendar budget calendar that you can import into your Google account.

Paycheck budgeting printable worksheet

You may find it easier to budget per paycheck versus the entire month, so here's a paycheck planner so you can track your money based on when income comes in. (via Wendaful)Bill pay checklist

This colorful single bill pay tracker will keep you on top of your recurring expenses. (via A Mom's Take)Financial binder printables pack

This 10+ page set includes:

- year at a glance budget worksheet

- month at a glance budget printable

- savings and debt trackers

- groceries and meal planning

- and more

(via Thirty Handmade Days)

Financial budget printables set

Here's another free set. In this kit, you'll get:

- expenses tracker

- household account numbers

- family budget sheet

- debt repayment plan

- bank account information

- bill payment checklist

- financial calendar

Family budget binder

This printable set has detailed worksheets to help you set and track progress towards your financial goals.

There's a goal-setting worksheet, a monthly expenses tracker, and assessment worksheet so you can find ways to improve with each month. (via Freebie Finding Mom)

Chic feminine budget binder

This simple 4-page set with ledgers and simple financial goals tracker printables comes in three styles: black and white, navy and coral, and gray and yellow. (via Blooming Homestead)Budget template with categories

Our free budget categories worksheet includes over 80 different line items, broken down into the following areas:

- Housing

- Utilities

- Groceries and household goods

- Transportation

- Healthcare

- Child care

- Pet care

- Minimum debt payments

- Travel

- Financial

- Other

Choose between a printable PDF version or a spreadsheet that automatically calculates your spending in each main area.

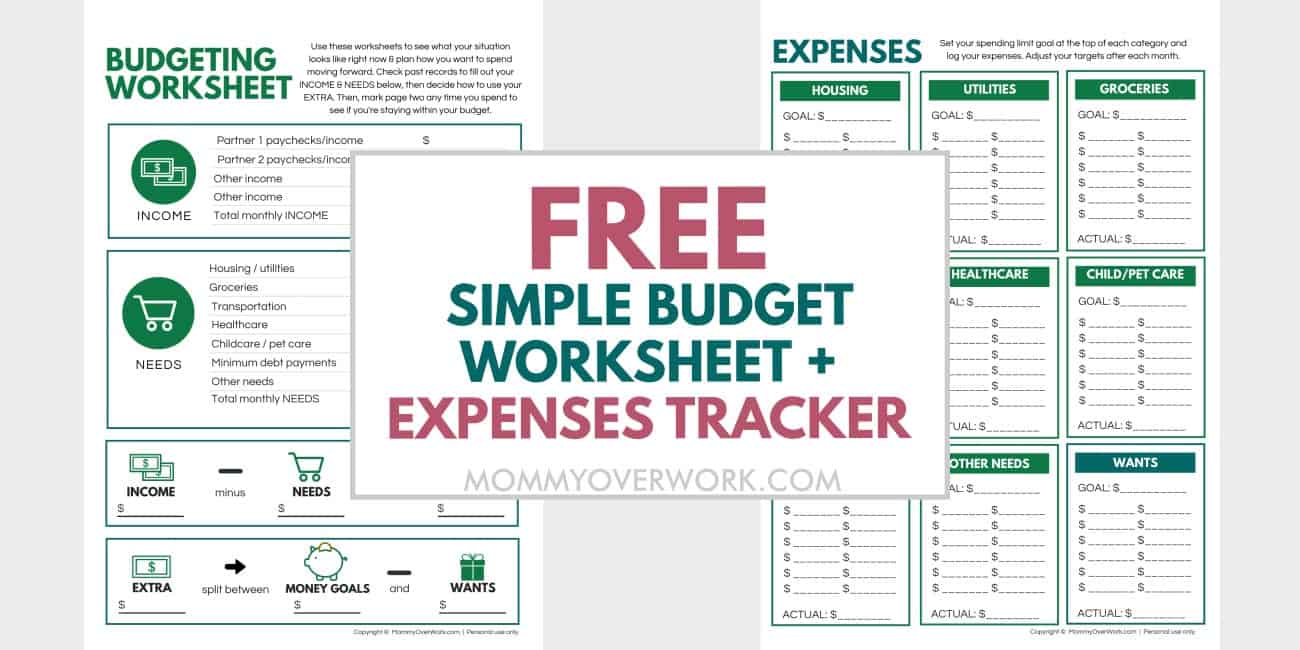

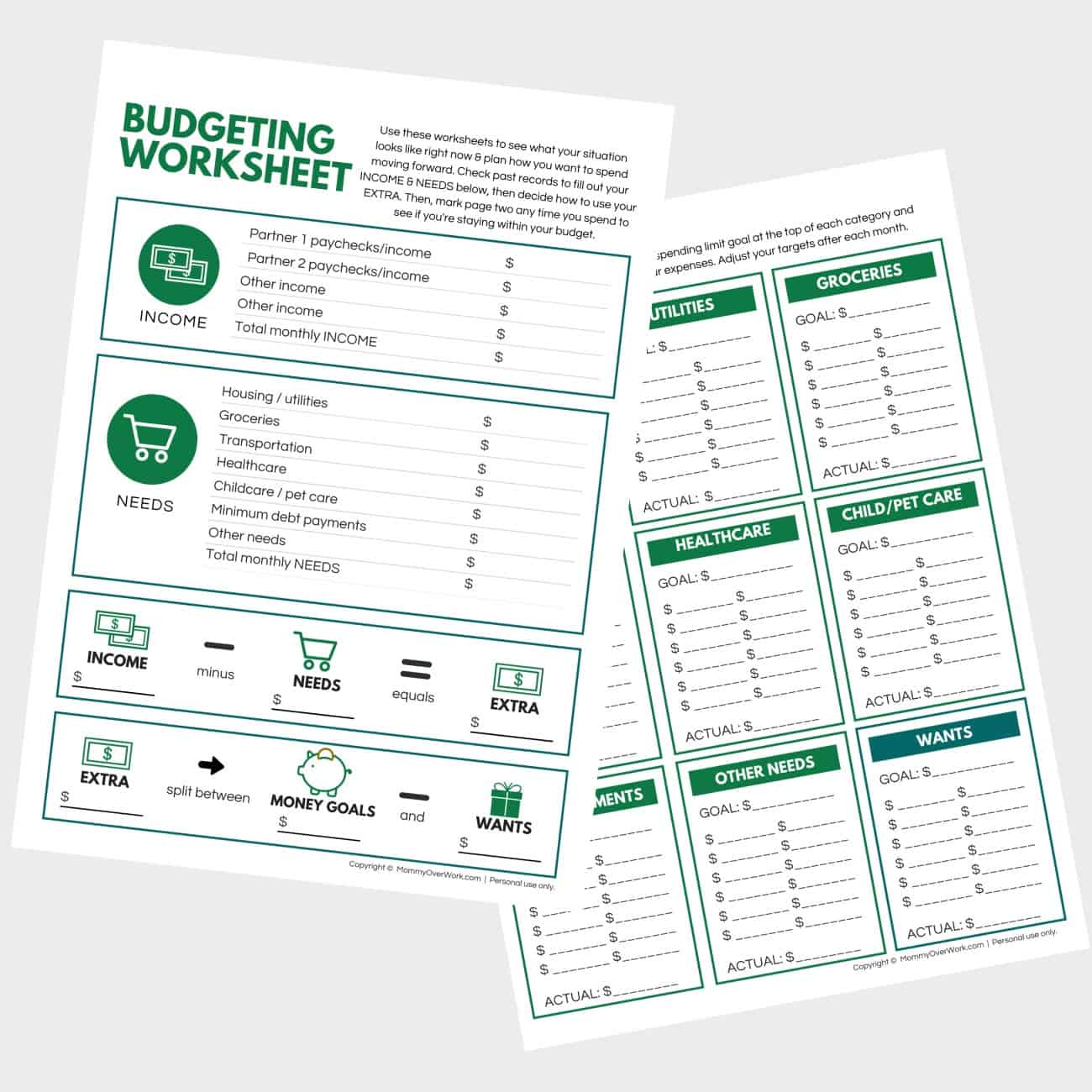

Simple budget worksheet

Our one-page budget worksheet is easy to use, even for beginner budgeters. Simply scroll past the image below to find the link to snag this freebie.

There's also a bonus single-page expenses tracker to help you simplify your spending as well.

Grab This Freebie:

[Personal use only. To help us continue to offer this free resource to others, please share this post (not the direct file) before clicking to the freebie. Thank you!]

Share This: Save Pin | FB Share

Get Free Printable: Get the File

Conclusion

These best free budget printable worksheets will not only help you stay on track and in control of your money, but the prettiness will also keep you motivated and organized with your finances.

Continue Reading: Save & Make Money posts →

- Cash Envelope System (+ free gorgeous envelope printables)

- Best Free Debt Trackers

Diane taber says

Looking for advice about being debt free one day

Sylvia Wu says

Hi Diane,

Thank you for dropping a note to say hello!

I wanted to start by saying that what you did for your parents is absolutely commendable and important. I know that caretaking is one of those things that is way harder than it seems, so I know you have at least several qualities that would make you a wonderful person and employee.

As for your situation, I see it as two problems put together, so let's address them each one at a time.

Problem 1: Landing a job

If you are really financially strapped, I think a wise strategy is to get a part time job asap first. By doing this, you can a) start to have some money to help alleviate the financial stress you're feeling, b) start plugging up the gap of unemployed time in your resume, and c) doing it part time still gives you some time to look for a full time gig.

Don't wear your worry to your interviews. You may be concerned that your employment gap will be a red flag for potential employers, but it won't be if you speak to it with confidence. You can explain that your parents fell ill and you knew it was the right thing to do to take care of them. Say they no longer need your care so you are excited to get back into the workforce again. If you don't show them you doubted the decision, they shouldn't either.

Every time I job hunt, I refer to this amazing book called Knock Em Dead Resumes. What I love about their book is that they give advice on various parts of the job hunting process but they also give TONS of examples of solid resumes for practically every field. It gives you an idea of the kinds of skills and accomplishments to think of that help sell yourself. I never prepare for a job without it. (I also just borrow it from the library, so I don't have to spend money on it).

Problem 2: Making do with what you have

Until you get another job, your other challenge is to figure out how to make due with what you have. To see big improvement, I would recommend focusing on the top two expenses that most people have: housing & food. I don't know your exact numbers but from what you wrote it sounds like a dire situation, so you may have to consider major change. You would relieve so much of your pressure if you could either take on roommates or move in with family. With the latter suggestion, you could make it a win for your family member by offering to pay something to them, like a reduced rent. That way, you both end up paying less for housing than you would if you lived apart.

As for food, there are three things our family does to really slash our spending:

1) Choose a super frugal meal and eat that everyday for breakfast or lunch. For example, I eat oatmeal with banana slices every day for breakfast. Both are dirt cheap so I get one meal out of the way for very little, like maybe $30-$40 for the whole month. You can double the savings if you use a similar strategy for breakfast AND lunch (for me, it's a peanut butter & jelly sandwich). I find that this also saves me time in the morning since I don't have to think so much about what I'm going to do for food and also makes me enjoy dinner a lot more too 🙂

2) Do a pantry purge challenge at least once a month. That means I make every meal from what I have on hand in the pantry, fridge, and freezer. I might allow myself something nominal like $10 to spend on fresh produce, but that means pretty much I go the entire week without spending a thing on food.

3) Shop exclusively at a warehouse club like Sam's Club or Costco. I'm not sure if you have these particular stores where you're from but hopefully you have something similar. I try to limit my purchases to non perishable stuff because my family just simply can't eat 10 pounds of potatoes before they go bad, but this really saves us a lot of money because we buy everything freezable or non-perishable from here.

I think it takes a lot of courage to reach out and ask for advice, so kudos to that and good luck! Thanks for stopping by!

Sylvia

Diane taber says

Hi me and my husband are going through a really hard time.at the moment as we’re trying to get our heads./around and and sort out our finances./as I’ve literally been everywhere for work.and can’t seem to find anything.as I keep going for interviews but nobody really seems to want to know./and what we find really tough to deal with is that I’ve always worked.but I had to stop work.i had to look after my mum and dad as they got older and fell very sick and it’s now that I’m trying to get in full time work we’re finding it so hard to get back in work again.as people do not seem very interested in getting people work as I’m not just looking for 1job I’m looking for 2jobs /to do.so this is why we’re going through such a really hard time at the moment./we are going through a plan between ourselves with just pen and paper/and trying to budget as before this/we just didn’t know how to budget/and where to start and have been watching you tube for a couple of months/and picked up a few tips along the way from you girls over the pond./ and just wanted to say hi/and hope you are well/and wanted a few tips from some one who’s been there where we are now.as we’re just worried to death about our situation.and me not working just isn’t helping us or our situation/we have stopped going out as we just can’t afford to./and my husband works night shifts./and we just need some of your advice./and wounderd what would be your advice please thank you take care bye Diane taber/